Get a UK Carnet

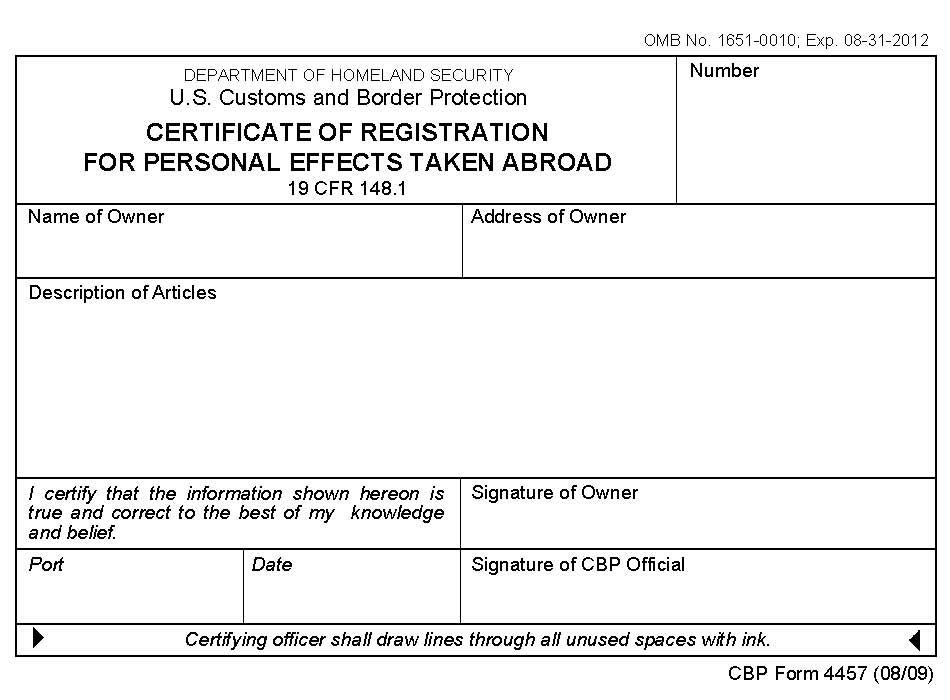

CBP Form 4457 is used to register personal items before you travel abroad to clear customs easily when you bring those personal effects back to the United States.

CBP Form 4457 is used to register personal items before you travel abroad to clear customs easily when you bring those personal effects back to the United States.You can get a CBP Form 4457 at the nearest CBP office prior to your departure or complete the form at the U.S. international airport from which you are departing.

The Certificate of Registration for Personal Effects Taken Abroad (CBP 4457), however, is not an acceptable temporary import document to avoid import duty and tax into foreign countries.

For foreign-made merchandise being sent abroad for repairs, alterations, exchange or upgrade or for use abroad, it is recommended to fill out a Certificate of Registration CBP Form 4455 before sending items to avoid paying duty when it returns.

The ATA Carnet is a multi-purpose temporary export / import document. An ATA Carnet can serve as the Certificate of Registration to avoid U.S. customs duties as well as serving as the temporary import document at foreign customs to avoid payment of import duties and taxes. Consult with a Carnet Specialist to determine whether you would benefit from using an ATA Carnet for your export shipment.